Karane Enterprises A Calendar-Year Manufacturer 2026 Planner Innovative Outstanding Superior. In the process of setting up the business, karane has acquired various types of assets. In the process of setting up the business,.

In the process of setting up the business,. In the process of setting up the business,. In the process of setting up the business,.

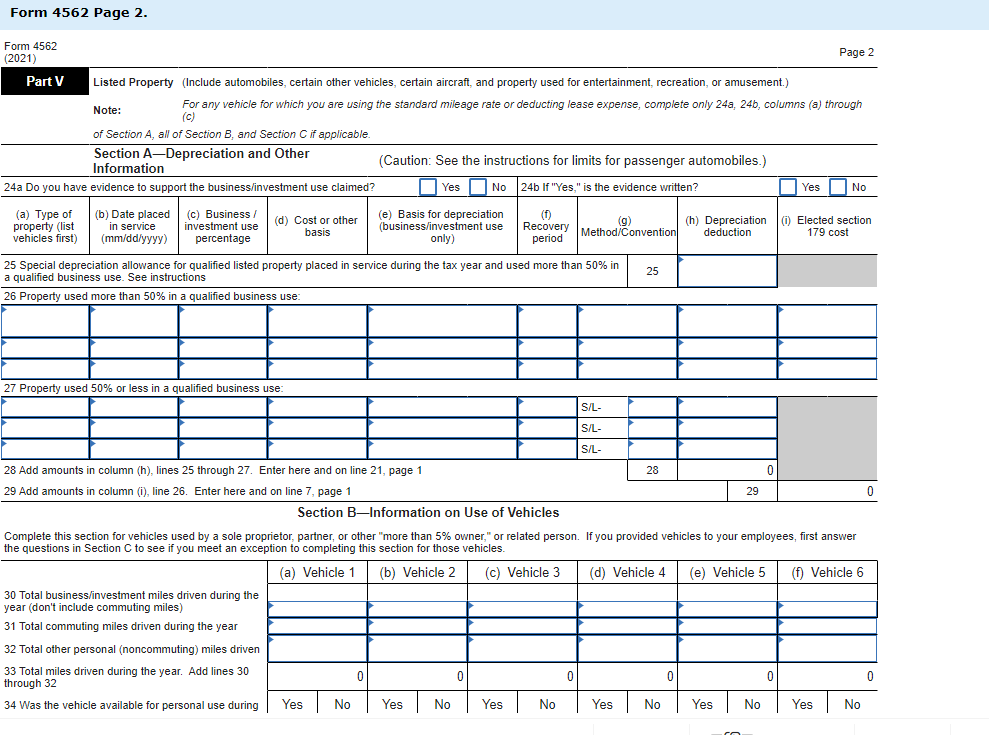

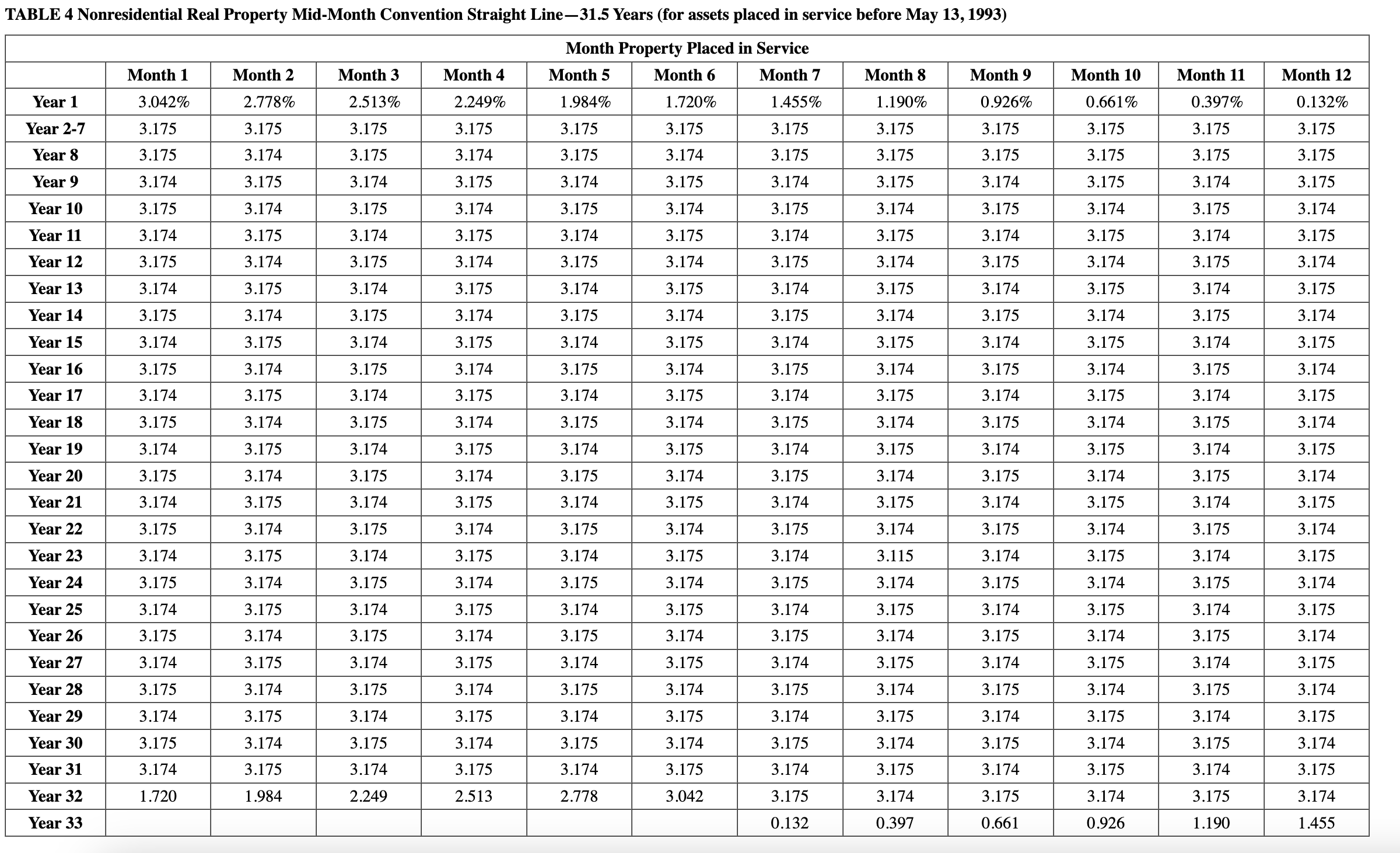

Source: www.chegg.com

Source: www.chegg.com

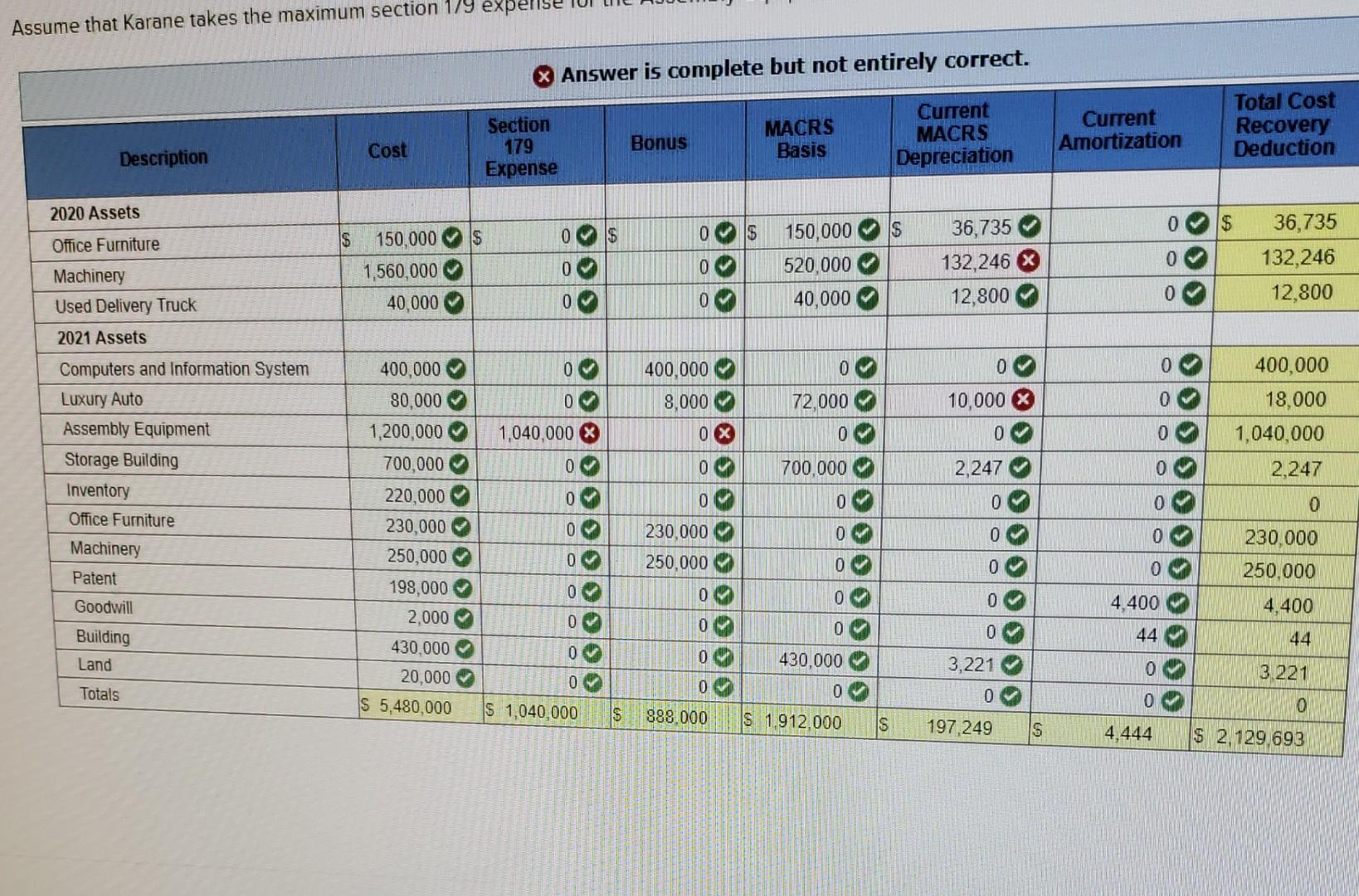

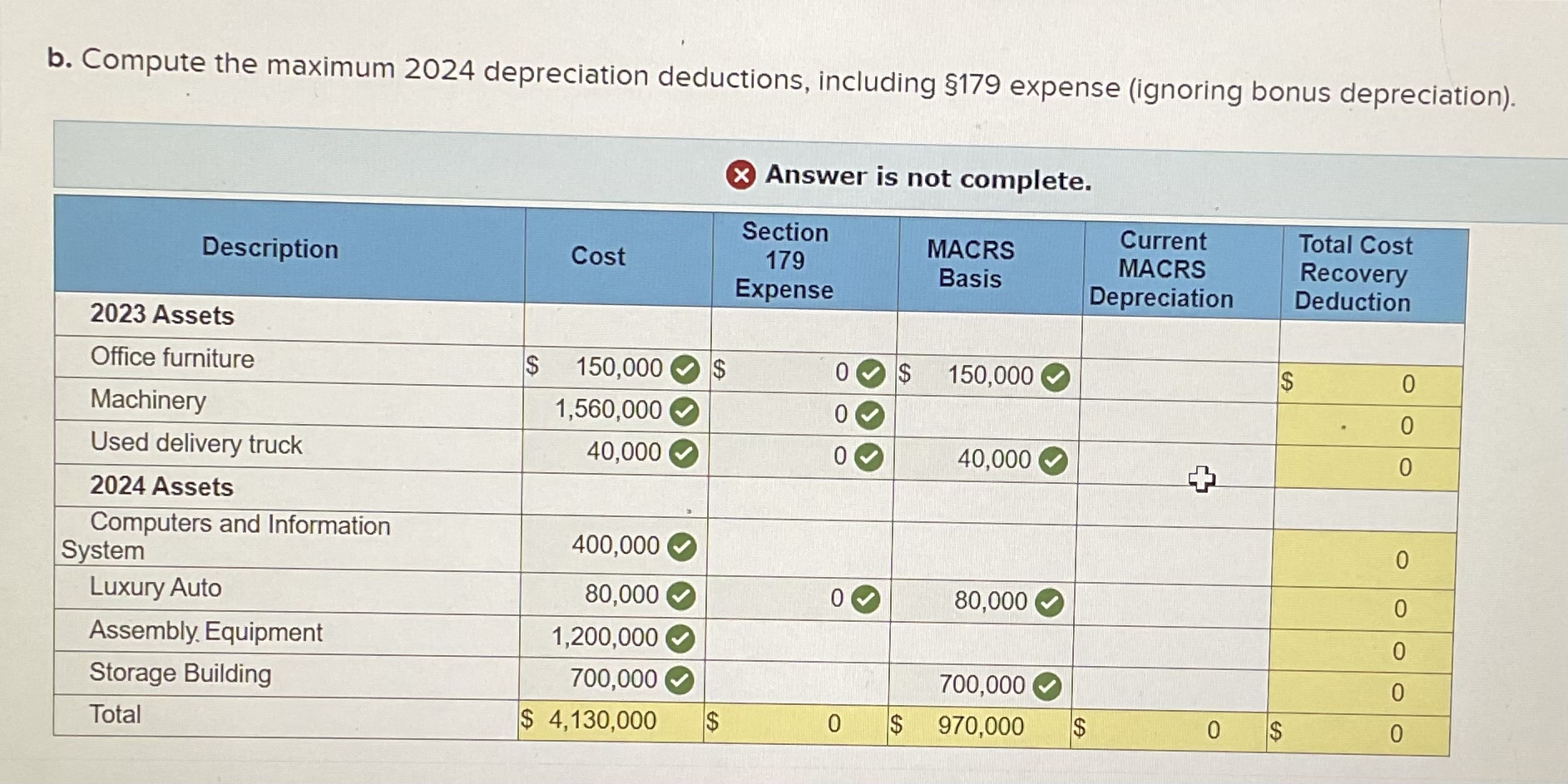

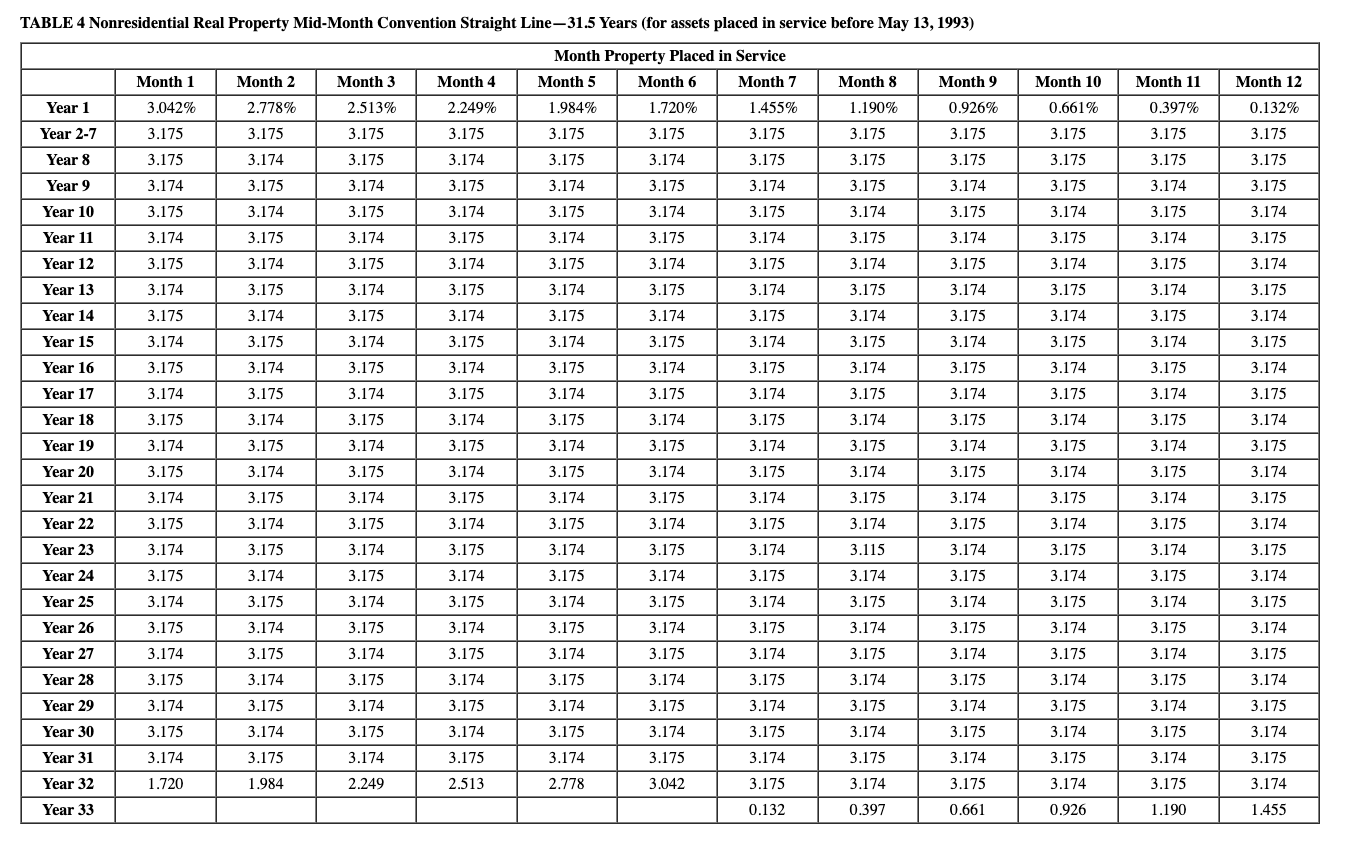

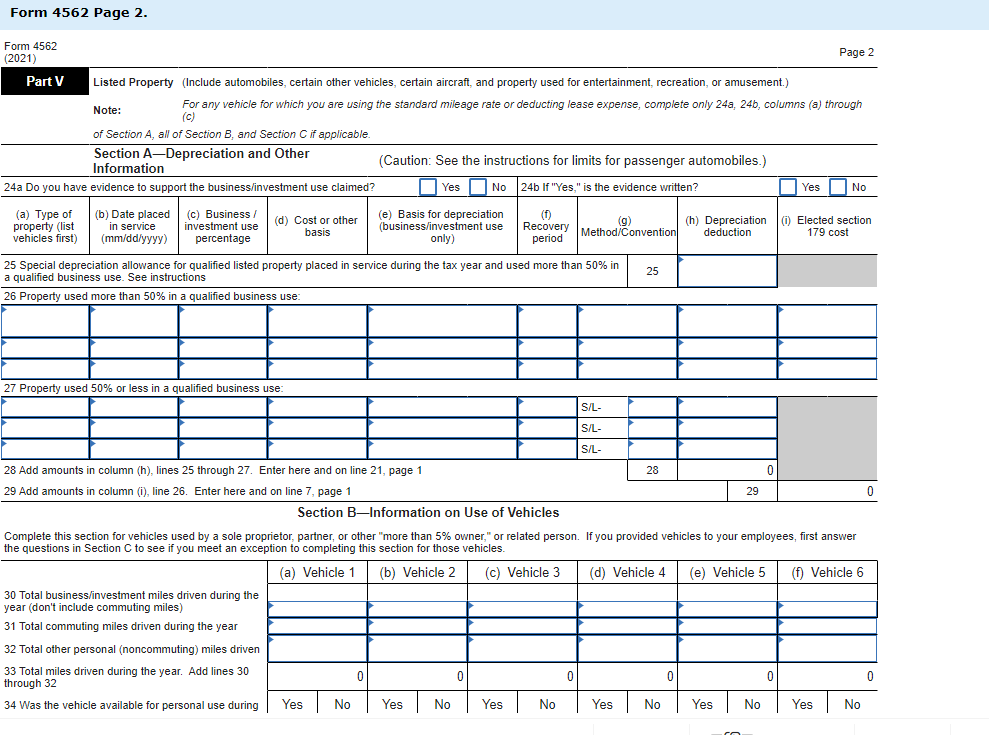

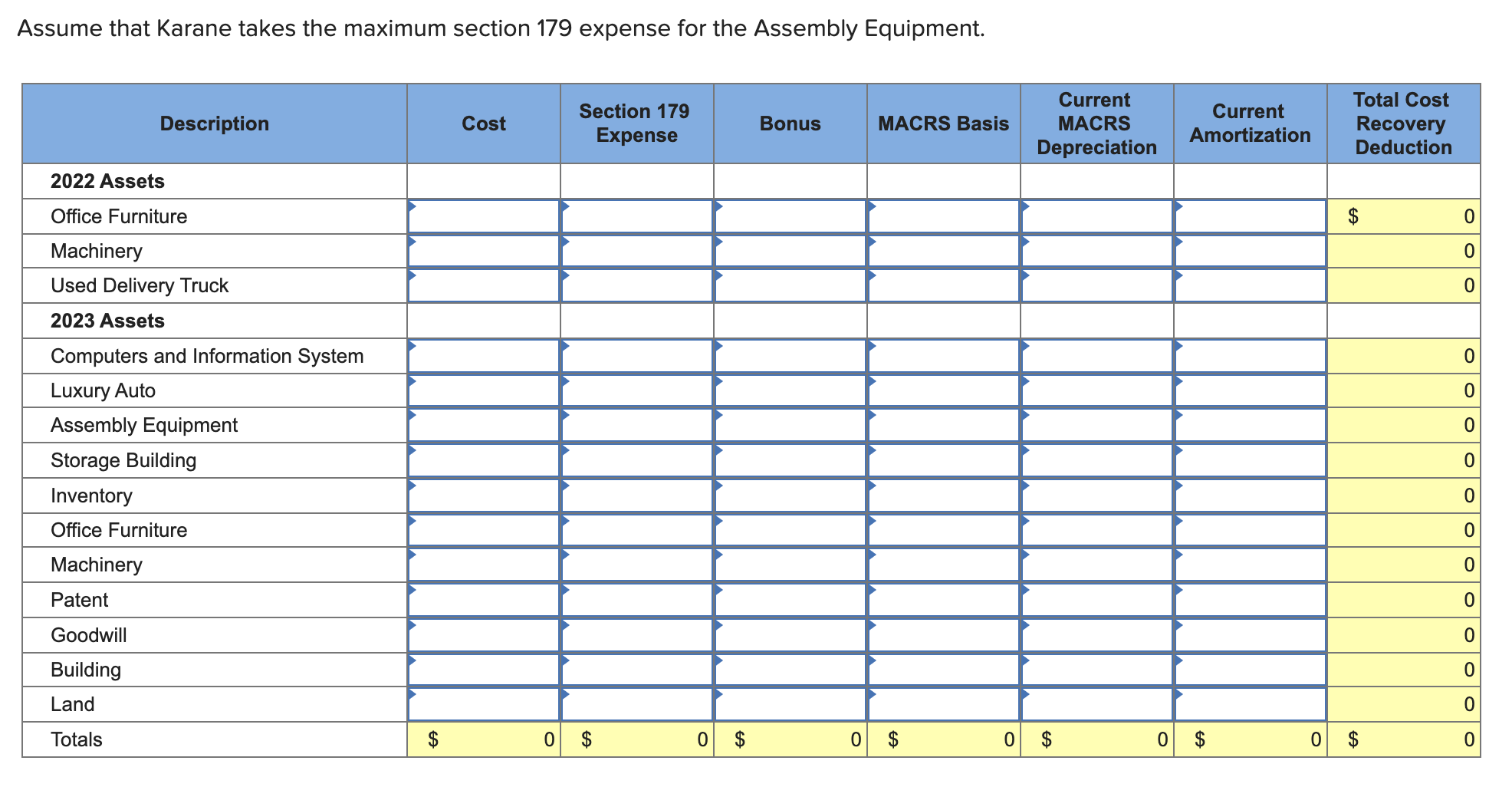

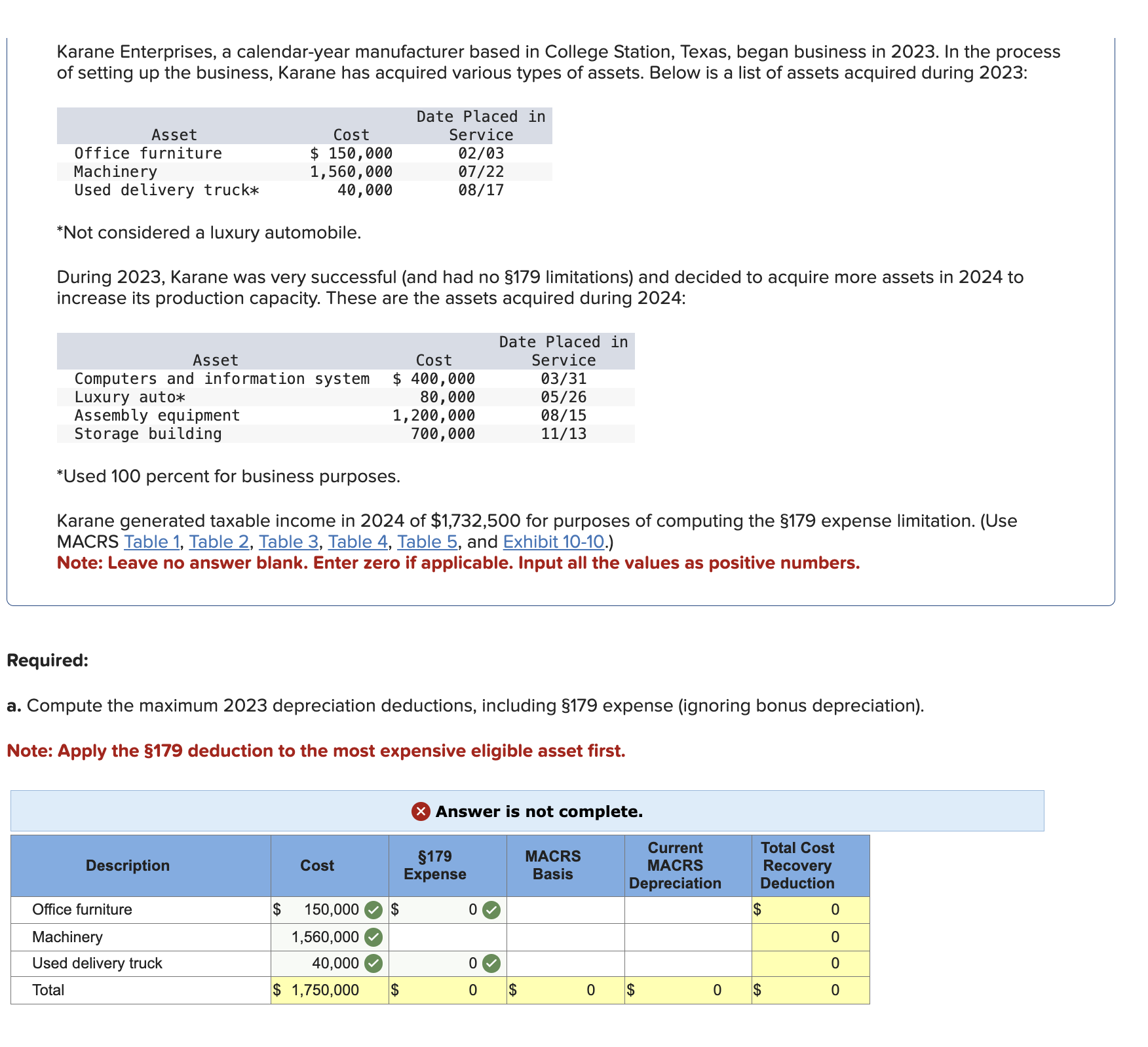

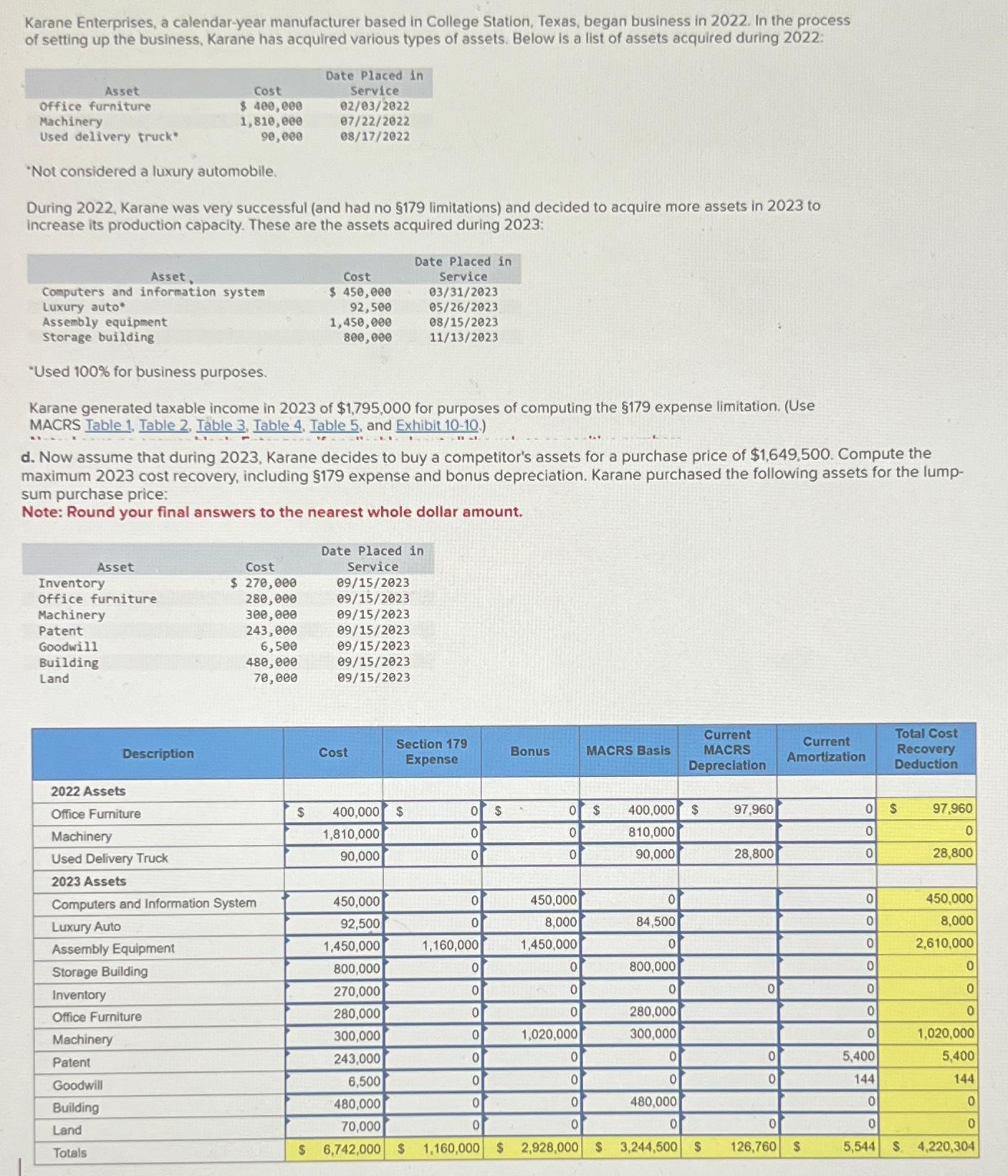

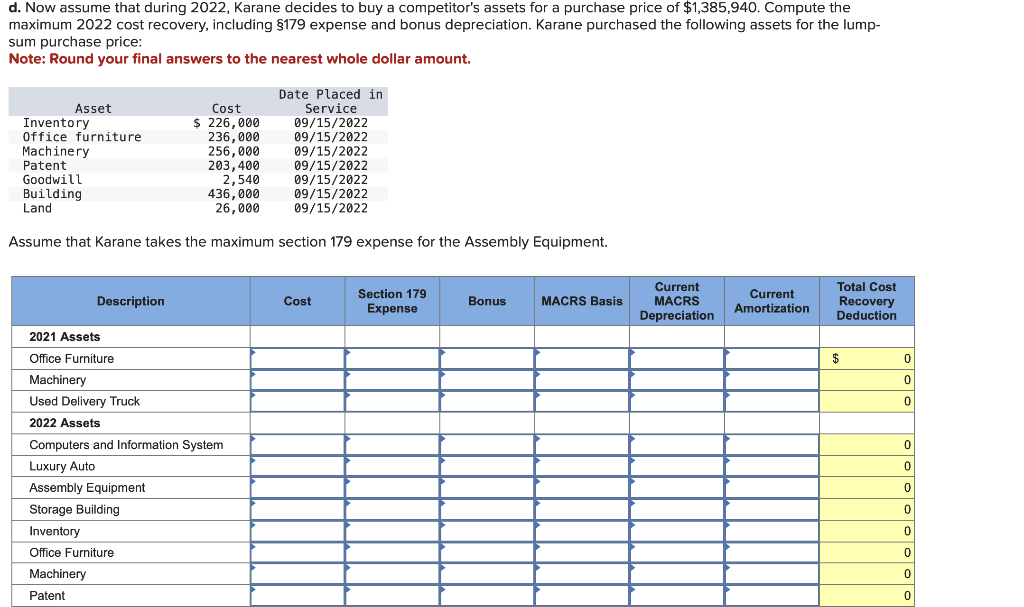

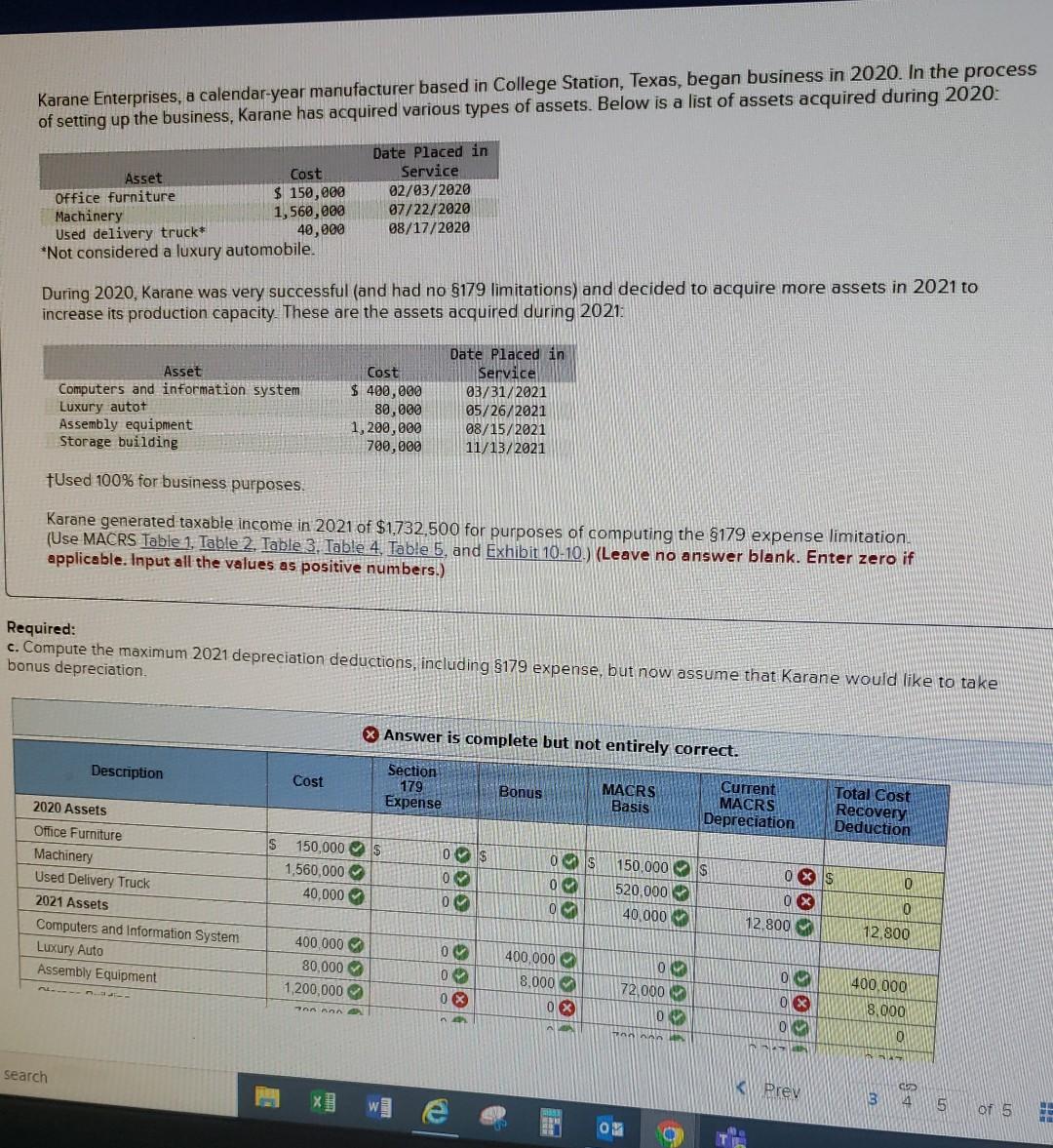

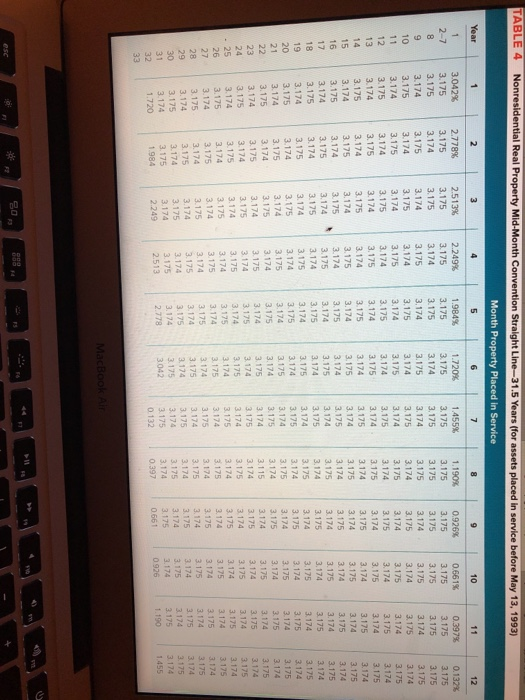

Solved Karane Enterprises, a calendaryear manufacturer To compute the maximum 2023 depreciation deductions for karane enterprises, including §179 expense and bonus depreciation, we will follow. During 2023, karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2024 to increase its production.

Source: www.chegg.com

Source: www.chegg.com

Karane Enterprises, a calendaryear manufacturer In the process of setting up the business, karane has acquired various types of assets. In the process of setting up the business,.

Solved Karane Enterprises, a calendaryear manufacturer In the process of setting up the business, karane has acquired various types of assets. During 2023, karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2024 to increase its production.

Karane Enterprises, a calendaryear manufacturer During 2023, karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2024 to increase its production. To compute the maximum 2023 depreciation deductions for karane enterprises, including §179 expense and bonus depreciation, we will follow.

Karane Enterprises A CalendarYear Manufacturer 2025 Bridgette B. Jelks During 2023, karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2024 to increase its production. In the process of setting up the business,.

Karane Enterprises, a calendaryear manufacturer In the process of setting up the business, karane has acquired various types of assets. In the process of setting up the business,.

Source: www.chegg.com

Source: www.chegg.com

Solved Karane Enterprises, a calendaryear manufacturer In the process of setting up the business, karane has acquired various types of assets. In the process of setting up the business,.

Karane Enterprises, a calendaryear manufacturer In the process of setting up the business,. In the process of setting up the business,.

Karane Enterprises, a calendaryear manufacturer In the process of setting up the business,. In the process of setting up the business,.

Source: www.chegg.com

Source: www.chegg.com

Solved Karane Enterprises, a calendaryear manufacturer In the process of setting up the business,. In the process of setting up the business,.

Source: www.bartleby.com

Source: www.bartleby.com

Answered Karane Enterprises, a calendaryear… bartleby In the process of setting up the business,. In the process of setting up the business,.

Source: www.chegg.com

Source: www.chegg.com

Karane Enterprises, a calendaryear manufacturer To compute the maximum 2023 depreciation deductions for karane enterprises, including §179 expense and bonus depreciation, we will follow. During 2023, karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2024 to increase its production.